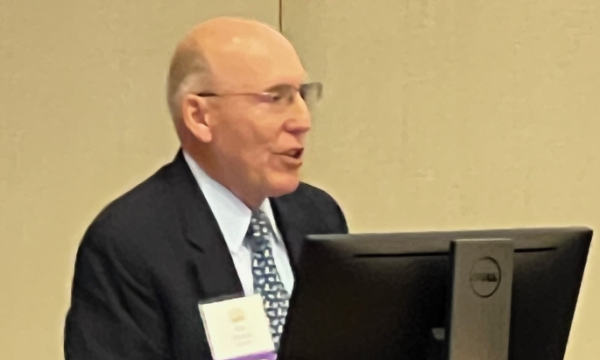

Dayton Bar 50-year Honoree, Paul Zimmer

Paul spent his legal career at PSE and retired as a Shareholder in June 2020. Paul’s 50-year career centered around Business Law and Merger and acquisition work. Please join us in thanking Paul for his service and congratulating him on his distinguished career.